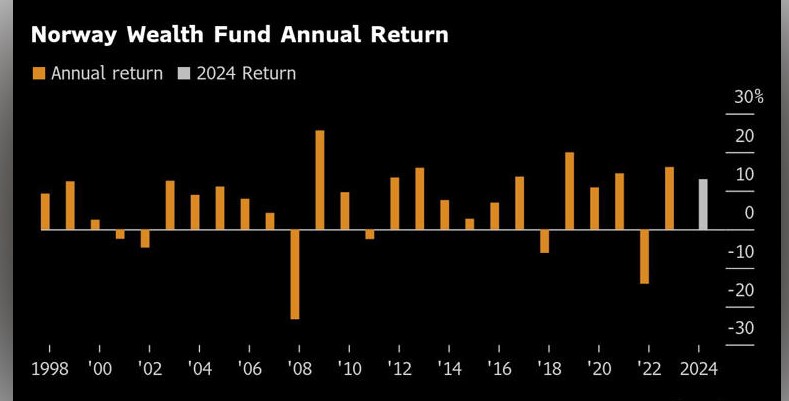

Norway’s sovereign wealth fund, worth $1.8 trillion, had a strong year in 2024, earning a 13% return, which equals about $222 billion. However, it still did not meet its target for the second year in a row, even though investments in US tech stocks did well.

The fund, managed by Norges Bank Investment Management (NBIM), made 18% from its equity investments, but a drop in real estate values caused the fund to miss its benchmark by 0.45%. The CEO of the fund, Nicolai Tangen, commented that US tech stocks had an especially strong performance.

Tangen also shared his thoughts on CNBC, saying that the second term of former President Donald Trump could benefit US companies by reducing regulations and spurring growth. However, he also mentioned that tariffs and labor restrictions could lead to inflation. He raised concerns about the high levels of government debt in various countries.

NBIM mainly follows an index-tracking approach, meaning it invests in a way that mirrors market trends and is overseen by Norway’s finance ministry. Despite this, the fund makes the most of its limited flexibility. It owns around 1.5% of every listed company globally. Since its creation in the early 1990s, it has focused on long-term investment, using Norway’s oil and gas revenues. Initially starting with only $300 million, the fund is now the largest single equity owner worldwide, investing mainly in publicly traded stocks.

The fund measures its performance using a custom benchmark based on the FTSE Global All Cap Index for stocks and the Bloomberg Barclays Index for bonds. In 2024, its investments in bonds brought in a return of 1%. However, its holdings in private real estate decreased by 1%, and its investments in renewable energy infrastructure fell by 10%.

In addition, the Norwegian government added 402 billion kroner (about $35.6 billion) to the fund in 2024.

The fund’s performance and growth are crucial as it helps support Norway’s economy, managing wealth generated from the country’s oil industry for future generations.

Leave a Reply