Managing shared phone bills can often lead to confusion and missed payments, especially in households where multiple members contribute to a single plan. AT&T recognizes this challenge and is stepping up with an innovative solution: AT&T SplitPay. This new feature not only sends timely text reminders to help users stay on top of their payments but also allows designated account members to pay their share directly, streamlining the entire process. With AT&T SplitPay, the hassle of coordinating payments is significantly reduced, making it easier for families and friends to manage their mobile expenses together.

| Feature | Description | Important Notes |

|---|---|---|

| AT&T SplitPay | Allows users to pay their share of the phone bill directly via a text notification. | 1. Users must be able to receive texts. 2. Late fees apply if the total bill is unpaid. 3. AutoPay with credit card must be changed to bank account/debit card. |

| Notification System | Sends a text message to designated payers when the bill is due, including a payment link. | Link is valid only until the payment due date. |

| Payment Process | Payers can click the link and pay directly on AT&T’s secure site without logging in. | Must coordinate with the primary account holder if the due date has passed. |

| Ease of Use | Simplifies tracking individual payments and allows resending notifications if needed. | Does not relieve primary account holder of responsibility. |

| Considerations | AT&T SplitPay is beneficial for shared plans, especially with family members. | Consider switching to an MVNO if no contract is in place to save money. |

Understanding AT&T SplitPay: A New Way to Share Bills

AT&T has introduced a new feature called SplitPay, which makes it simpler for families and friends to share their phone bills. With this feature, users can receive text notifications when the bill is due, allowing them to pay their part easily. This means that if you share a phone plan with siblings or friends, everyone can contribute their share without any confusion. Just imagine how much easier it will be to keep track of who owes what!

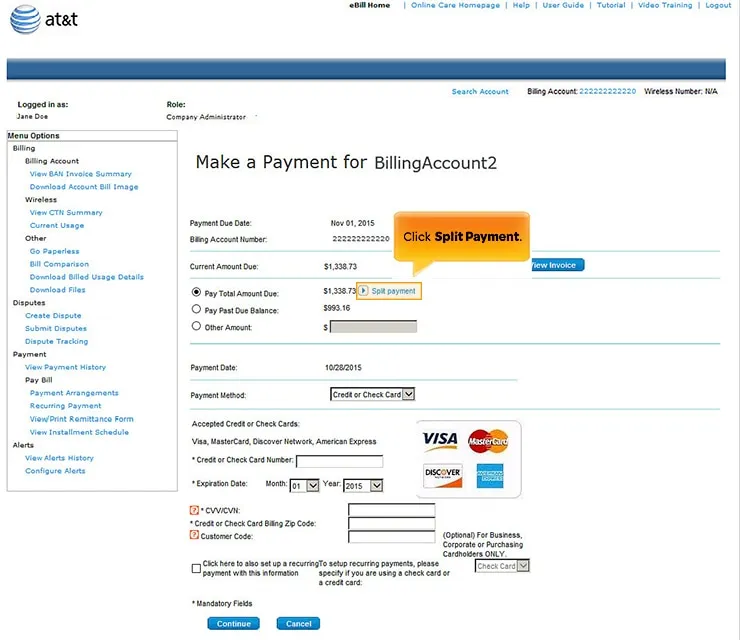

Setting up AT&T SplitPay is easy and can be done through the AT&T website or app. Once you set it up and choose who will pay, each user will get a text reminder when it’s time to pay. They can click on the link in the message to pay their share directly. This way, there’s no need for anyone to chase after their friends or family to get the bill paid on time!

The Benefits of Using SplitPay for Your Phone Bill

One of the major benefits of using AT&T SplitPay is that it helps avoid late fees. If everyone pays their part on time, there won’t be any surprises on the bill. However, it’s important to remember that if one person forgets to pay, the primary account holder is still responsible for the total payment. So, while SplitPay makes it easier, it’s still a good idea for everyone to stay organized and keep track of their payments.

Another advantage of SplitPay is the ability to resend payment notifications. If someone hasn’t paid their share by the due date, you can easily remind them using the app or website. This feature is helpful for keeping everyone informed and ensuring that the bill gets paid. Plus, if someone can’t receive the text notifications, they might miss out on paying their share, so it’s essential to check that everyone is set up correctly.

Things to Keep in Mind When Using SplitPay

While AT&T SplitPay is a great tool for managing phone bills, there are some important things to consider. For instance, if you have AutoPay set up with a credit card, you will need to switch to a bank account or debit card to use SplitPay. This change ensures that everyone can pay their share without any issues. It’s always good to keep your payment methods updated to avoid any last-minute problems.

Additionally, remember that SplitPay only works for devices that can receive text messages. If someone on your plan does not have a device that can get texts, they won’t receive the payment link. This could make it tricky for them to pay their part, so it’s smart to check that everyone involved is able to use the feature. Being aware of these details will help everyone enjoy the benefits of AT&T SplitPay smoothly.

Understanding AT&T’s SplitPay Feature

AT&T’s SplitPay feature is designed to enhance the way account holders manage their mobile phone bills. By allowing designated users to receive notifications via text when the bill is due, it streamlines the payment process and reduces the burden on primary account holders. This means no more chasing down family members or friends for their contributions; instead, they can pay directly through a secure link sent to their phones.

Setting up AT&T SplitPay is straightforward, requiring just a few clicks on the AT&T website or app. Once configured, users can enjoy the convenience of timely reminders and direct payment options. This feature not only promotes accountability among users but also fosters a sense of financial responsibility, making it easier for everyone involved to keep track of their contributions to the shared bill.

The Benefits of Shared Bill Management

Managing shared bills can often lead to misunderstandings and disagreements, especially in larger households. AT&T’s SplitPay feature alleviates these issues by ensuring that all parties are informed and reminded of their financial obligations. This clarity helps to prevent late payments, which can incur additional fees and service interruptions, ultimately saving time and money for all users.

Moreover, the ability to resend payment notifications is an invaluable tool for primary account holders. If someone forgets to pay their share, the primary can easily send another reminder, ensuring that responsibilities are met without frustration or confusion. This feature encourages a collaborative approach to managing shared expenses, making it more efficient and less stressful.

Navigating Payment Responsibilities and Limitations

While AT&T SplitPay simplifies the process of shared payments, it’s crucial for users to understand their responsibilities. The primary account holder remains liable for the total bill, and if any designated payer fails to contribute, the consequences can affect everyone involved. Late payment fees can quickly accumulate, emphasizing the importance of timely contributions from all parties to avoid disruption of service.

Additionally, users need to be aware of the limitations associated with this feature. For instance, if the primary account holder has AutoPay set up with a credit card, they must switch to a bank account or debit card to enable SplitPay. This requirement may complicate the process for some users, so it’s essential to evaluate how best to manage payments before fully committing to the feature.

Making the Most of AT&T SplitPay

To fully benefit from AT&T’s SplitPay feature, account holders should proactively communicate with their designated payers about their roles and responsibilities. Establishing a clear understanding of when payments are due and ensuring that everyone is enrolled in the notification system can lead to a smoother payment experience. This proactive approach minimizes the risk of late payments and fosters a sense of accountability among all users.

Furthermore, leveraging the technology available through the AT&T app can enhance the overall experience. Users can track their payments and stay updated on any changes to the billing cycle. By utilizing these tools, account holders can take control of their finances and ensure that managing a shared mobile plan remains a hassle-free process.

Frequently Asked Questions

What is AT&T SplitPay?

**AT&T SplitPay** is a feature that lets users of a phone plan pay their share of the bill directly. It sends a text when the bill is due with a link for easy payment.

How does AT&T notify users when the bill is due?

AT&T sends a **text message** to users designated as payers. This message includes a link to pay their part of the bill without logging in.

Can I use SplitPay if I have AutoPay set up?

No, you cannot use **SplitPay** if you have **AutoPay** with a credit card. You must switch to a **bank account** or **debit card** for it to work.

What happens if someone doesn’t pay their share of the bill?

If a member fails to pay, the primary account holder is still responsible. A **late fee** may be added, and service could be suspended if the total isn’t paid.

What should I do if my payer doesn’t receive the payment link?

If a payer doesn’t get the link, they must be able to receive **text messages**. If they can’t, they need to work with the primary account holder to pay.

How can I track payments with AT&T SplitPay?

**AT&T SplitPay** allows you to easily track who has paid and who hasn’t. You can even resend a payment reminder if someone forgets to pay.

What should I do if the payment due date has passed?

If the due date has passed, the payment link won’t work. The payer must contact the primary account holder to arrange payment.

Summary

AT&T has introduced a feature called SplitPay, which notifies users via text when their phone bill is due, allowing them to pay their share directly. Set up through the AT&T website or app, designated users receive a payment link that directs them to a secure site for payment, eliminating the need to log in. However, primary account holders remain responsible if payments are missed, as late fees may apply. SplitPay cannot be used with AutoPay linked to credit cards, and only devices capable of receiving texts can be enrolled. This feature enhances bill management, especially for shared plans.

Leave a Reply