In an era where digital currencies are reshaping the financial landscape, a staggering $1.5 billion crypto heist has sent shockwaves through the industry, potentially marking the largest theft in cryptocurrency history. Dubai-based crypto exchange Bybit has fallen victim to hackers who exploited security vulnerabilities, raising critical questions about digital asset safety in an increasingly complex environment. While Bybit asserts it can absorb this monumental loss, the incident underscores the evolving dynamics of the crypto space, where once whimsical ventures like NFT games now coexist with serious financial institutions. This remarkable shift invites scrutiny of both security practices and the legitimacy of emerging tokens, setting the stage for a deeper exploration of the implications of this unprecedented breach.

| Aspect | Details |

|---|---|

| Crypto Heist Amount | $1.5 billion |

| Company Affected | Bybit |

| Location of Company | Dubai |

| Previous Record Holder | Axie Infinity ($617 million) |

| Method of Attack | Exploit of security features |

| Company Assets | $20 billion |

| Founder Statement | Can cover the loss via assets or loan |

| Second Largest Heist | Axie Infinity ($617 million) in 2022 |

| Theft Method for Axie Infinity | Exploited security flaw in Ronin sidechain |

| Group Behind Axie Theft | North Korea-linked Lazarus Group |

| Current Status of Axie Infinity | Still available for download, but impacted by crypto crash |

| Evolution of Crypto Landscape | Transitioned from quirky games to serious finance |

| Emergence of Meme Coins | Debate on legitimacy amid drastic value changes |

| Controversy in Argentina | President Milei’s alleged promotion of Libra token |

| Author Information | Ted Litchfield, Associate Editor |

The Massive Bybit Heist: What Happened?

Recently, a major crypto heist occurred involving Bybit, a Dubai-based crypto company. Hackers stole a staggering $1.5 billion worth of Ethereum from Bybit’s digital wallet. This incident could become the largest crypto theft in history, surpassing the previous record by a huge margin. Bybit has not provided details on how the hackers gained access, but they mentioned that the attack exploited certain security features.

Despite the enormity of the loss, Bybit has reassured its users that they are safe. The company claims to have enough assets, around $20 billion, to cover this theft without harming its customers. The founder, Ben Zhou, stated that they could recover from this incident through their existing resources or by taking a loan. This shows that while the heist is significant, the company’s financial stability remains intact.

Comparing Bybit and Axie Infinity: Lessons Learned

Bybit’s experience contrasts sharply with that of Axie Infinity, which lost $617 million in a previous crypto heist. The Axie Infinity theft was linked to a security flaw in its game, which is a popular platform for trading NFTs. Even after suffering this major loss, Axie Infinity continues to operate, although the crypto market’s downturn affected its player base and game value. This shows how different companies handle crises and adapt to challenges.

The difference in responses highlights how the crypto world is evolving. Bybit has positioned itself as a strong player in the finance sector, while Axie Infinity remains a game focused on entertainment. This evolution indicates that companies in the crypto space must take security seriously and learn from past mistakes to protect their assets and users. As the market matures, the lessons from these heists will shape better practices for the future.

The Rise of Meme Coins and Market Trends

In addition to the significant heists, the crypto market has seen the rise of meme coins, which are cryptocurrencies often linked to internet culture and trends. These coins, like Hawk Tua coin and Trump coin, have sparked debates about their legitimacy. While some people invest in them for fun, others worry about the risks involved. The unpredictable nature of these coins can lead to dramatic changes in their value, making them a double-edged sword for investors.

Interestingly, even political figures like Argentinian president Javier Milei have faced scandals related to promoting questionable tokens, which can harm many individuals financially. This situation emphasizes the importance of being cautious in the crypto market. As new trends emerge, especially with meme coins, it is crucial for investors to do their research and understand what they are buying into. The crypto landscape continues to change, and staying informed is key to navigating it successfully.

Understanding the Mechanics Behind Crypto Heists

Crypto heists, such as the one involving Bybit, often exploit vulnerabilities in digital wallets or blockchains rather than relying on traditional hacking techniques. In Bybit’s case, the attack was described as an exploit of ‘security features,’ indicating that attackers found a loophole in the system’s design. This highlights the importance of robust cybersecurity measures, as even minor oversights can lead to catastrophic financial losses in a sector where billions of dollars are at stake.

The evolution of hacking techniques in the crypto space reflects a growing sophistication among cybercriminals. Unlike earlier attacks that may have relied on social engineering tactics, modern heists target the underlying technology of cryptocurrencies. By understanding these mechanics, crypto firms can better secure their assets and minimize risks, thus fostering a safer environment for both investors and users.

The Impact of Crypto Heists on Investor Confidence

When a major crypto exchange like Bybit is compromised, it raises significant concerns among investors regarding the safety of their funds. This particular heist, if successful, could further erode confidence in the crypto market, which is already grappling with volatility and regulatory scrutiny. Investors may become more wary, leading to decreased trading activity and a potential downturn in asset prices, which can affect the wider market.

However, Bybit’s assertion that it can absorb the loss helps to mitigate some of these fears. By demonstrating financial resilience, the company may reinforce investor confidence, showing that it remains a viable player in the crypto ecosystem. The balance between transparency and security will be crucial for Bybit and other firms to regain trust and ensure the long-term stability of the market.

Lessons Learned from Previous Crypto Heists

The history of crypto heists offers valuable lessons for both firms and investors. By examining cases like the Axie Infinity breach, which exploited a security flaw, stakeholders can identify common vulnerabilities and work towards strengthening their defenses. This incident also underscores the necessity for ongoing audits and updates to security protocols to adapt to evolving threats in the digital landscape.

Furthermore, the contrast between the responses of Bybit and Axie Infinity highlights the importance of crisis management. Bybit’s proactive approach in assuring investors reflects the need for companies to have robust strategies in place to handle emergencies. Learning from past mistakes can lead to improved security measures and better investor relations, ultimately contributing to a more resilient crypto ecosystem.

The Future of Cryptocurrency Security

As cryptocurrency continues to grow in popularity, the need for enhanced security measures becomes increasingly critical. The recent heist involving Bybit serves as a reminder that even established firms are vulnerable. In response, the industry is likely to see a surge in investment toward advanced security technologies, including multi-signature wallets, decentralized finance solutions, and artificial intelligence-driven threat detection systems.

Moreover, regulatory bodies may step up efforts to enforce stricter compliance measures, ensuring that companies prioritize security and transparency. As the landscape evolves, it is essential for both crypto companies and investors to stay informed about potential risks and to adopt best practices. A collective commitment to security will be pivotal in shaping a safer future for cryptocurrency.

Frequently Asked Questions

What happened in the Bybit crypto heist?

Bybit, a crypto company, lost **$1.5 billion** in Ethereum after hackers broke into its digital wallet. This could be the largest crypto theft ever recorded!

How did the hackers access Bybit’s wallet?

The exact method is unclear, but Bybit mentioned that the hackers exploited **security features**. This means they found weaknesses in the system instead of tricking someone.

What does Bybit say about the loss?

Bybit claims it can handle this loss easily because it has **$20 billion** in assets. They say both the company and its customers will be okay.

How does this heist compare to previous crypto thefts?

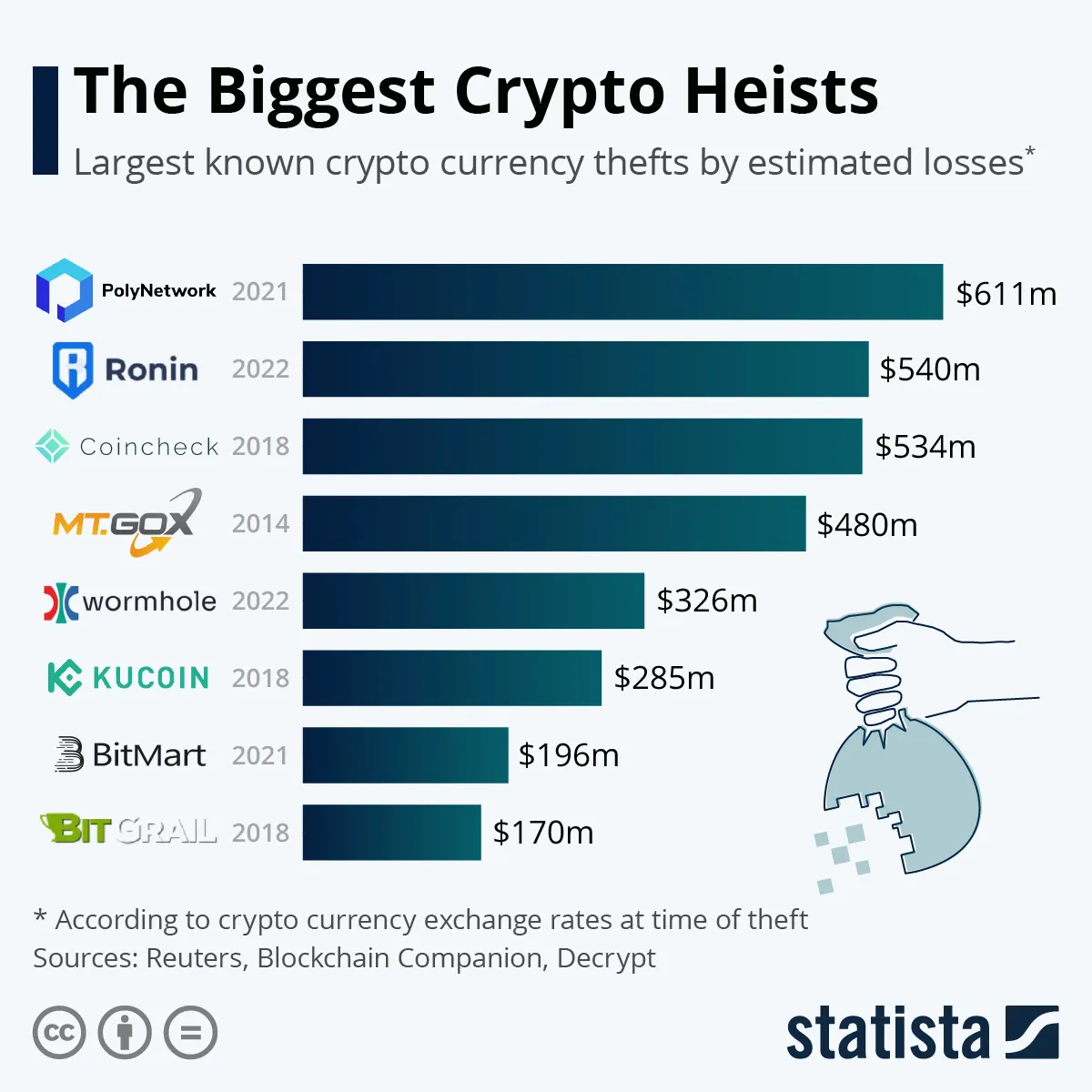

This heist is much larger than the second biggest, which took **$617 million** from Axie Infinity in 2022. Bybit’s theft more than doubles that amount!

What is a meme coin?

A **meme coin** is a type of cryptocurrency that started as a joke but gained popularity. Examples include Hawk Tua coin and Trump coin, though their value can change quickly.

Who is linked to the Axie Infinity heist?

The Axie Infinity heist was reportedly carried out by a group connected to **North Korea**, called the Lazarus Group, which is known for cyber crimes.

Why did the crypto landscape change over the years?

The crypto world has shifted from quirky projects to a serious financial market. Companies like Bybit are now seen as major players, unlike simple games like Axie Infinity.

Summary

The content discusses a significant $1.5 billion crypto heist involving Dubai-based Bybit, which, if successful, would become the largest theft in crypto history. Hackers exploited security features to breach Bybit’s digital wallet, although the company asserts it can absorb the loss due to its substantial $20 billion asset base. The narrative contrasts this heist with the $617 million theft from Axie Infinity, demonstrating the evolution of the crypto landscape from quirky games to serious finance players. Additionally, the piece touches on controversies surrounding meme coins and the implications of such scams within the cryptocurrency market.

Leave a Reply